3 Practical Areas in Which CFOs are Using Advanced Analytics to Drive Financial Performance

November 9, 2018 Business Intelligence

The advent of data analytics has led to a massive shift in the traditional roles of CFOs from record keeping to becoming strategic leaders within organizations. CFOs must seize this opportunity and use it to elevate financial performance of organizations. Failing to do so will make them miss out on expanding their impact on non-finance departments such as marketing, operations and IT.

The use of analytics in companies has seen a shift from being customer centric to using it for operational support. The use of analytics is getting focused towards achieving financial and risk management objectives, as well as rooting out fraudulent activities. The CFO is leading the way in achieving these outcomes with the help of advanced analytics (AA) and business intelligence (BI) tools.

Here’s a look at 3 practical areas in which advanced analytics is helping CFOs drive this revolution-

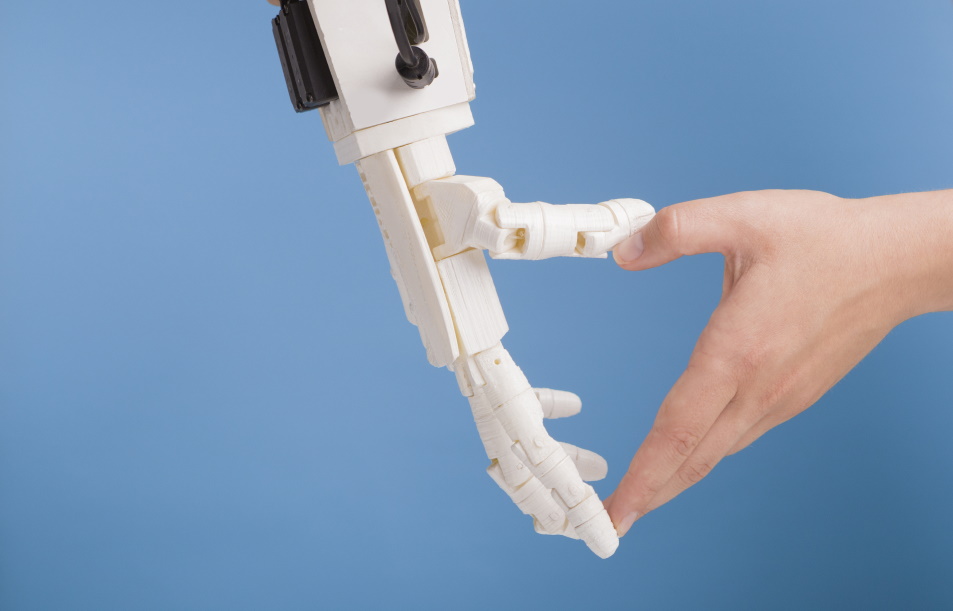

Photo by rawpixel on Unsplash

1. Analyze trends in real-time

The speed with which analytics is refreshed and used to make decisions is going to be a key element that will differentiate a company from its competition. This would be a combination of the speed at which an organization acquires data, and the time it takes to blend it with the traditional ERP data to come up with new elements.

With the help of big data analytics, CFOs can process information easily. With a wide range of modeling and visualisation options, it is easy for members of the financial team to interpret the hidden meaning of data. Organizations can save tons of time and reduce the probability of error by moving beyond analysing in spreadsheets. The presence of data under one umbrella can help CFOs understand patterns, examine financial performance and make decisions based on solid facts, all in real-time.

2. Apply predictive analytics to make better decisions

Advanced analytics helps to integrate algorithms and predictive model actions into the business processes. Predictive analytics software can optimize results from processes such as call centres, online interactions and manufacturing productivity to achieve maximum operational efficiency.

Predictive analytics can be used to identify components key to financial growth and the advanced expertise can be developed over a wide range of performance management processes such as planning, forecasting, budgeting, reporting and modelling. This can help CFOs make data-driven decisions to achieve growth.

3. Integrate financial and operational information

In order to utilize advanced analytics in all its digital capacity and drive financial performance, it needs to be fully integrated into the business processes. CFOs can achieve this with the right advanced analytics and business intelligence tools; and have a centralised control of operational business decision making.

Integration will give CFOs the power to find key budget efficiencies and the ability to view and capture data from a variety of sources. This can help identify better revenue streams, improve efficiency, spot conflicts and loopholes, see a growing return on their investments and find ways to increase market share of their organization.

Advanced analytics gives CFOs an opportunity to align data with key business objectives, improve decision making and expand the impact of the entire financial team on organisation’s operations. These ways are practical in today’s competitive world and can truly change the course of organizations and their financial performance.

Related Posts

Recent Posts

Archives

Categories

Categories

- Advanced Analytics(3)

- Automation(1)

- Business Intelligence(3)

- Guide(1)

- Integration(1)

- Robotic Process Automation(3)

- Uncategorised(1)

How the Pandemic has Accelerated the Need for RPA

Oct 22, 2020

How Non-Profits Can Benefit from RPA

May 9, 2019

Introduction to Advanced Analytics Maturity Model

Dec 12, 2018